Insights | 02 January, 2025

Going Public: A Guide to IPOs

An IPO, or initial public offering, refers to the first […]

As China opens its capital markets, the “Measures for the Administration of Strategic Investment in Listed Companies by Foreign Investors” (effective December 2, 2024) offer a prime opportunity for foreign investors. This policy facilitates strategic investments and partnerships, providing a clear path to access China’s vast market while supporting the global expansion of Chinese enterprises. Cross-border equity swaps, a key feature, enable partnerships that go beyond traditional investment models, offering more flexible opportunities. By streamlining investment processes and enhancing governance, the policy fosters long-term, mutually beneficial relationships in key sectors like technology, industrials, and energy. This is the moment for foreign investors to capitalize on China’s economic transformation and drive global growth and innovation.

The Ministry of Commerce and the China Securities Regulatory Commission, among other departments, have jointly issued the “Measures for the Administration of Strategic Investment in Listed Companies by Foreign Investors” ((Decree No. 3 of 2024, hereinafter referred to as the “New Measures”), effective on December 2, 2024.

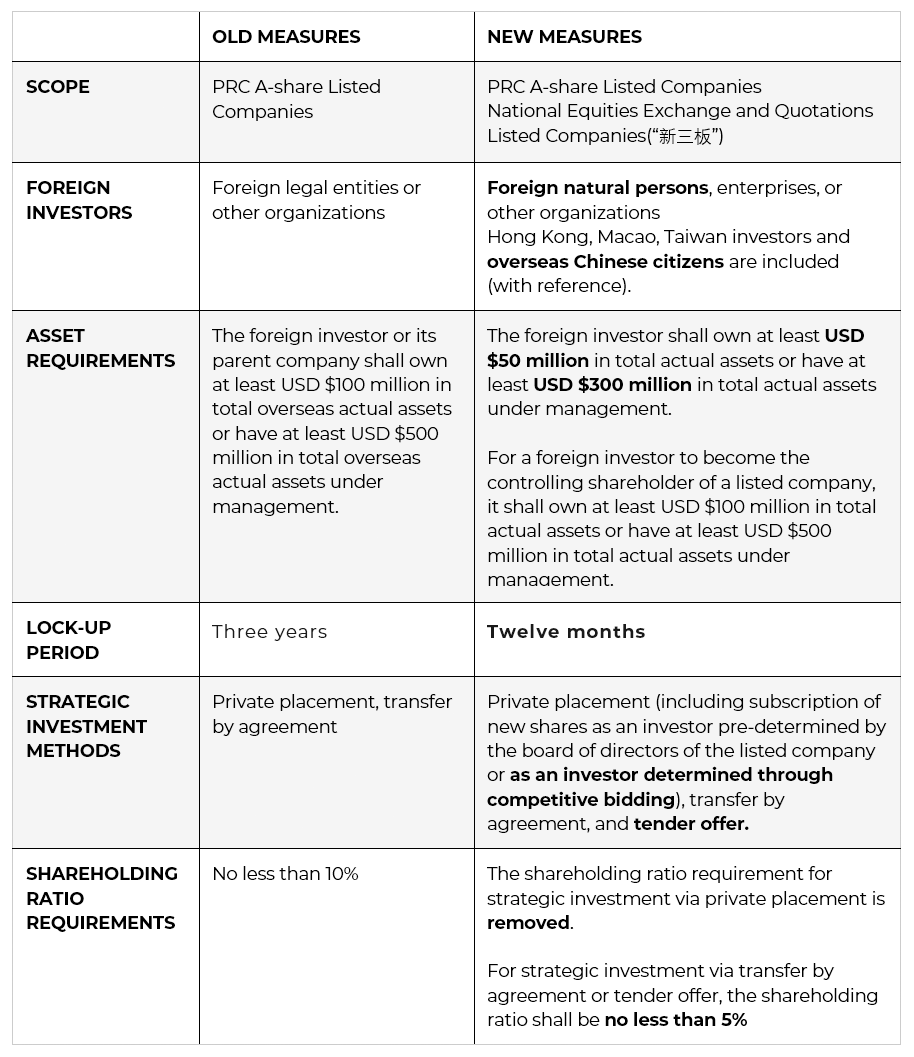

The updated measures build on the 2005 version (Decree No. 28 of 2005, hereinafter referred to as the “Old Measures”), highlighting China’s commitment to opening its capital markets and providing clear pathways for global investors while supporting the international growth of Chinese enterprises.

Compared to the Old Measures, the New Measures have made the following adjustments to further encourage foreign strategic investment:

1) Enhancing Foreign Investment Opportunities through Cross-Border Equity Swaps

The New Measures present a fresh, powerful opportunity for foreign investors and Chinese companies alike through cross-border equity swaps. Key benefits include:

2) Simplifying Investment Processes and Enhancing Governance

With the New Measures, the regulatory process has been streamlined. The shift to post-investment reporting significantly cuts down approval times, making it easier and faster for foreign investors to close deals. Chinese companies are also encouraged to strengthen their governance practices, ensuring greater transparency. Stronger governance means less risk, building foreign investors’ confidence when they engage in joint ventures or acquisitions.

3) Strengthening Strategic Partnerships and Expanding Market Reach

The New Measures pave the way for deeper, long-term relationships between foreign investors and Chinese companies. Cross-border equity swaps lay the foundation for these partnerships, offering access to China’s large consumer market and integrating foreign firms into global supply chains. Collaborating with local Chinese companies also gives foreign investors valuable insights, helping them navigate and innovate within China’s fast-changing business environment.

As noted by Hutong Research in the “China Economy Q&A” report, policy changes like the debt-mitigation plan, which allows local governments to settle payments to vendors and employees, are expected to be more effective than direct stimulus in boosting investor confidence. These measures, along with the “New Measures” that ease asset requirements and reduce lock-up periods, align with China’s broader goal to create a more investor-friendly environment, offering strategic opportunities for global expansion and partnership.

Background:

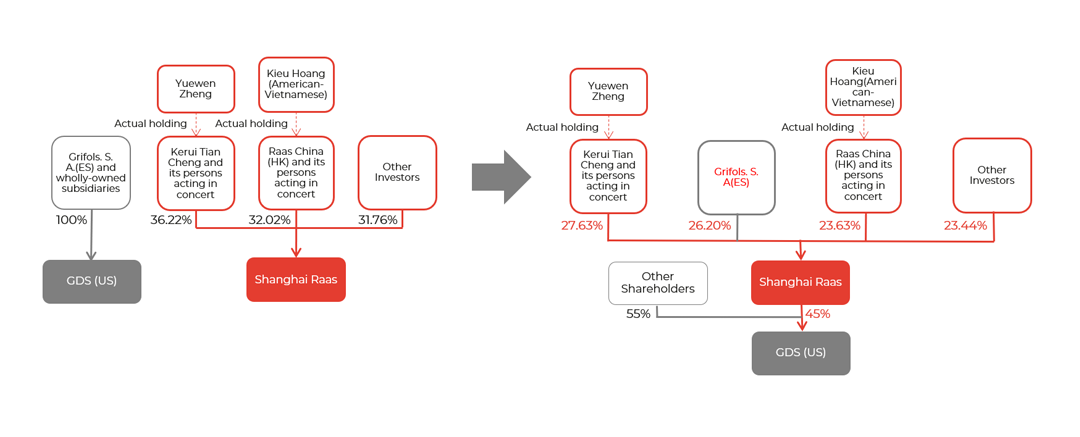

On March 30, 2020, Shanghai RAAS Blood Products Co., Ltd. (Shanghai RAAS, 002252.SZ) announced a share issuance to Grifols. S. A. (“Grifols”) for a 45% stake in Grifols Diagnostic Solutions Inc. (“GDS”). The shares were listed on March 31, with Grifols transferring 45% of “GDS” equity to Shanghai RAAS on March 13. This case study is sourced from Grifols’ official website.

Significant Challenges:

The New Measure is designed to optimize cross-border equity swaps for Chinese firms and their international partners in the following three keyways:

The New Measures unlock exciting new opportunities for global investors interested in China. Cross-border equity swaps and streamlined regulatory processes reduce entry barriers, allowing international companies to partner more easily with Chinese firms.

This policy creates a dynamic environment where both sides can benefit. Chinese companies gain access to global capital, technology, and expertise, while foreign investors tap into China’s massive market potential. The result? Long-term, mutually beneficial partnerships that fuel innovation and strengthen business ecosystems.

Whether you’re looking to expand globally or collaborate on innovative technologies, the New Measures offer the chance to be part of China’s next phase of market growth and international transformation.

Author:

Evelyn Ding

Associate Consultant

Author:

Johan Annell

Partner

Read more about our advisory & strategy expertise

References

Receive our latest market insights, news and reports, and business bulletins.