Insights | 02 January, 2025

Going Public: A Guide to IPOs

An IPO, or initial public offering, refers to the first […]

As 2025 approaches, many industry leaders are forecasting a strong year for mergers and acquisitions (M&A) as a confluence of macro tailwinds positions the market for robust deal activity. Key drivers include a stabilization in the cost of capital, abundant private equity dry powder and rapid economic shifts fueled by AI and technological innovation.

At the December U.S. Federal Reserve meeting, Chairman Powell reduced the target federal funds rate to 4.25%-4.50%, signaling an additional 50bps of cuts for 2025—down from the 100bps guidance provided in September. While the forecasted cost of capital remains elevated, its stabilization could facilitate alignment between buyers and sellers on valuations. In addition, the economy remains strong, with U.S. GDP projected to grow by 2.2%-3.3% in 2025(1) while unemployment currently sits at 4.2%, well below its 30-year average of 5.7%(2). With political uncertainty easing following the conclusion of the global election cycle, businesses are better positioned to focus on strategic planning.

Meanwhile, inflation remains above the fed’s 2.0% target, but Consensus Economics forecasts a decline to 2.1% by mid-2025 as key drivers, such as housing and insurance, normalize, further supporting a favorable environment for M&A activity.

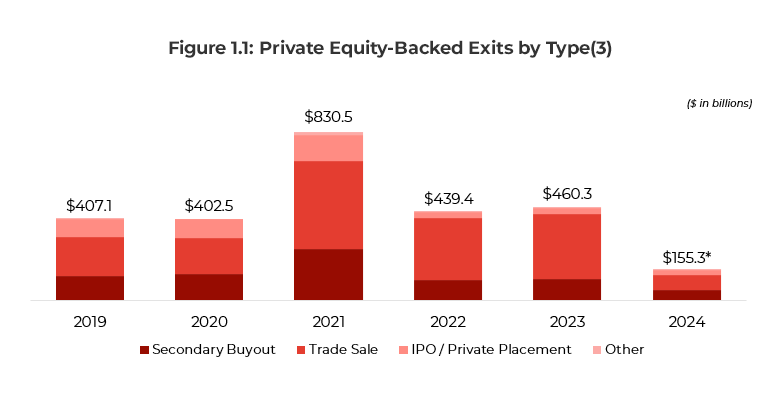

Alongside positive economic conditions, the private equity sector is poised for significant activity in 2025. Dry powder currently sits at a record high of $2.6T(3), the 2021 investment cycle nears the end of its term and limited partners are pressuring private equity firms to liquidate legacy investments and return capital. As these factors collide, and interest rates continue to recede, PE firms are predicting a busy year for investments in 2025. Martin Brand, head of North America Private Equity at Blackstone, anticipates that Blackstone private equity exits will more than double year-over-year in 2025.

Innovation-driven industries will continue to be a focal point for M&A in 2025. Technology companies, particularly in AI, cloud computing, and cybersecurity, are attracting significant interest from both strategic acquirers and private equity firms. As these sectors evolve, businesses are leveraging inorganic growth strategies to stay competitive. This is especially true as digital transformation efforts accelerate globally, driving demand for companies that provide industry-leading solutions. The intersection of technological disruption and easing macro headwinds creates a strong environment for deal-making.

Author:

Maxwell Mosbacher

Senior Investment Analyst

Read more about our M&A expertise

References

*YTD through 06/30/2024

Receive our latest market insights, news and reports, and business bulletins.