Insights | 27 December, 2024

Perfect Storm for M&A Boom in 2025

As 2025 approaches, many industry leaders are forecasti […]

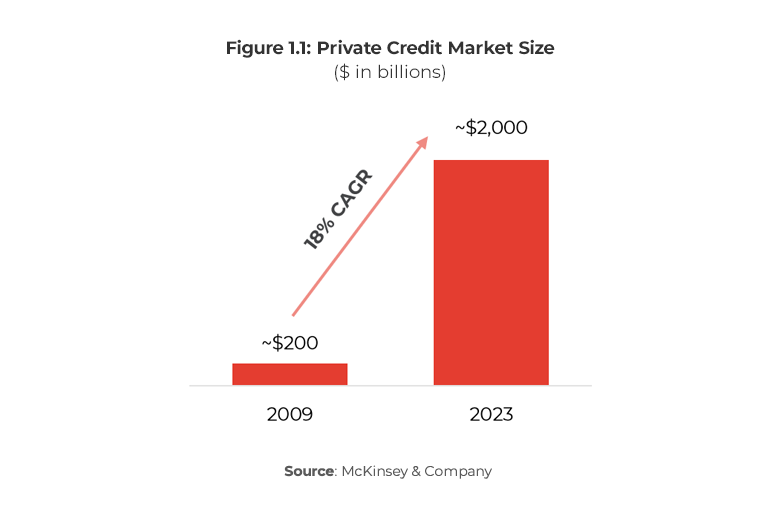

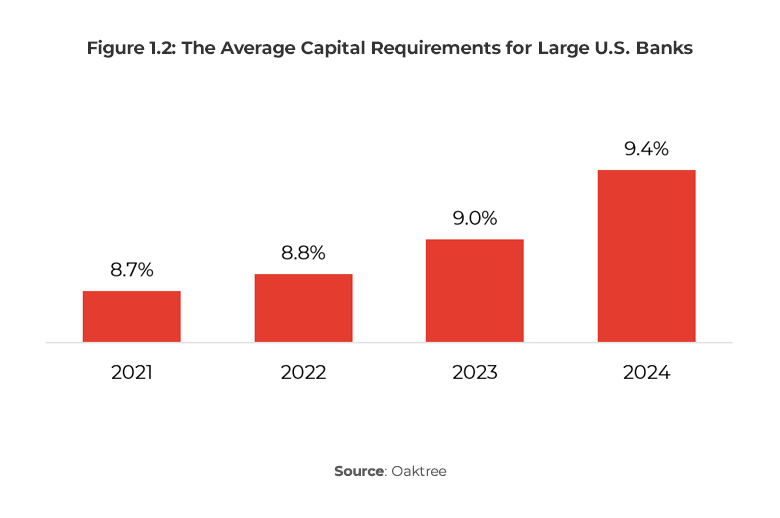

The growth in private credit has been staggering since the Global Financial Crisis (GFC), expanding to ~$2T at the end of 2023, a 10-fold increase from 2009 levels (Figure 1.1). The major catalyst behind the growth was the implementation of stricter bank regulations associated with the Basel III framework. These regulations, developed in response to the bank failures during the GFC, introduced higher capital requirements (Figure 1.2) for banks, effectively increasing banks’ cost to lend. The private credit market capitalized on this opportunity, as the lending model of private credit funds allows for better alignment between the duration of assets (loans) and the duration of liabilities (investor capital), thereby mitigating the liquidity risks that contributed to the financial crisis.

While many of the Basel III regulations are already in effect, the final rules, often referred to as the “Basel III endgame”, are scheduled to be implemented in mid-2025. The endgame rules, which have yet to be finalized (the current proposal was released in July 2023) will impose stricter capital and liquidity requirements on banks, further constraining their lending capacity and risk-taking abilities. Institutional investors and research analysts anticipate that these regulatory changes will cause banks to reprioritize their lending activities, potentially creating a large lending gap that private credit and alternative asset managers are well-positioned to fill.

Over the next decade, lending sectors most likely to transition away from banks include asset-backed finance, infrastructure, commercial real estate and jumbo residential mortgages. In the U.S. alone, this transition could shift an estimated $6T of assets out of the banking sector(1), offering new investment opportunities and spurring additional growth in the private credit markets. In addition, BlackRock anticipates that regulatory pressures associated with the Basel III endgame could drive a significant increase in Synthetic Risk Transfers (SRTs), with projections suggesting 30% – 40% annual growth over the next two years(3). SRTs, which allow banks to transfer credit risk on loan portfolios to third-party investors without selling the underlying assets—and thus avoiding immediate losses—could be another growing market for private credit investors seeking steady income and potentially higher yields. With $500bn of estimated dry powder in the private capital markets(4), and intensified competition amongst capital providers, fund managers are likely to explore these new strategies to broaden their scope of investment and capitalize on the increased bank regulations.

Author:

Maxwell Mosbacher

Senior Investment Analyst

Read more about our advisory & strategy expertise

References

Receive our latest market insights, news and reports, and business bulletins.